What type of account is sales returns?

What type of account is sales returns?

Sales returns is a nominal account. Generally, sales returns show zero or favourable balance (Debit balance). It can also be termed as a contra-revenue account as sales returns reduce our sales revenue.

Is sales return an asset or liability?

Sales returns and allowances are not liabilities, which go on the balance sheet, nor can you simply reduce the amount of sales revenue in your ledgers to reflect returns.

Are sales returns an income?

In the sales revenue section of an income statement, the sales returns and allowances account is subtracted from sales because these accounts have the opposite effect on net income. Therefore, sales returns and allowances is considered a contra‐revenue account, which normally has a debit balance.

Where do sales returns go on an income statement?

Both transactions are different, but are grouped together under the account title “Sales Returns and Allowances” in the income statement. This item typically goes below the “Total Sales” figure on the statement.

How do you treat sales returns?

Is sales return an account receivable?

Sales returns for when a customer used store credit If a customer originally made their purchase on credit, the sale was part of your accounts receivable, which is money owed to you by customers. Recording a purchase return for a sale made on credit is a little different than when a customer pays cash.

Is returns outwards an expense or income?

Supplier – This is a reduction in payables for the business. Return Outwards – This is a reduction in expenses for the business….Journal Entry for Return Outwards.

| Supplier’s A/C | Debit | Debit the decrease in liability |

|---|---|---|

| To Return Outwards A/C | Credit | Credit the decrease in expense |

Where do sales returns go on the balance sheet?

Record the Return For a credit sale, debit accounts receivable and credit sales. If you are collecting sales taxes, credit the appropriate sales tax liability account on the balance sheet. Cash and accounts receivable are balance sheet asset accounts. The sales account is an income statement account.

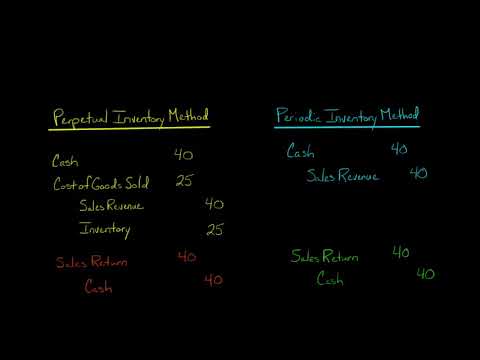

What is the entry for sales return?

Entries for sales returns are recorded by passing the following journal entry: Sales return A/c – Dr. After the sales return book is properly updated and all transactions are entered into the book, the total of the items is transferred to the ledger in an account called the Sales returns account.

What is not an expense account?

Purchase of Equipment or Furniture. This very large deduction from your account will not show on your Income Statement as the furniture is an asset, not an expense. It is something tangible that is owned by the business, will be useful for more than a year, and will still have value at the end of the year.

What accounts are under expenses?

Examples of expense accounts are Costs of Sales, Cost of Goods Sold, Costs of services, Operating expense, Finance Expenses, Non-operating expenses, Prepaid expenses, Accrued expenses and many others. Below you’ll find more details of these example expense accounts.

Is cost of sales an expense?

Cost of Goods Sold is also known as “cost of sales” or its acronym “COGS.” COGS refers to the cost of goods that are either manufactured or purchased and then sold. COGS counts as a business expense and affects how much profit a company makes on its products.

Is sales return debit or credit?

Sales return accounts are debited while the buyers’ or the customers’ accounts are credited in the seller’s account. Purchase accounts are reduced. Sales accounts are reduced. A debit note is issued to the seller or the supplier of the goods.

What is the accounting effect for sales return?

Treatment of Sales Returns in the Financial Statements Return inwards or sales returns are shown in the trading account as an adjustment (reduction) from the total sales for an accounting period. It is not shown in the income statement or the balance sheet.